Article

Unlock the way to change B2B buying processes

Removing the struggle to buy in B2B

Remaining Relevant With New B2B Buying Behaviors

Digital transformation is not an event but a process, and it looks different for every B2B business

It is this one-size-definitely-does-not-fit-all landscape that can be confusing to B2B businesses; they are under pressure to digitalize, but often don’t know where to start. What inhibits many is the assumption that they won’t have transformed “properly” unless they are selling directly from their site or sites.

In this article, we take the emphasis away from the B2B purchase to the B2B purchase process, and how this is changing faster than seemed possible only five or 10 years ago.

Traditionally, B2B decision-making went from A to B to Z like points on a map, taking the buyer to an order in predictable stages, because this is all that the technology allowed.

B2B customers now regularly use ten or more channels to interact with suppliers (up from just five in 2016).

We are in a different world now. Digitally skilled B2B buyers prefer to explore product, price, and supplier online for as long as possible, without the distraction of meeting a sales rep face-to-face. This means in effect that instead of having just one conversation with your buyer, you are having many. According to McKinsey, B2B buyers now typically use 10 distinct channels during their decision-making journey, up from five only a few years ago.

The new multichannel, non-linear B2B buying process has been aptly described as a “loop”. A loop has no beginning, and no end – just as the B2B purchase process does not end the moment an order is placed.

The challenge for the B2B supplier is two-fold: to be relevant through every twist and turn of this disrupted purchase process, and to help its customers to buy.

As we describe the complexity that is the modern B2B decision-making process, we shall explore in tandem how Digital Experience Platforms give businesses the tools to harness this complexity, now and in the future.

The B2B Buying Process and its Stakeholders

The B2B decision-making process can be divided into five phases. Of course there is no neat cut-off point where one phase ends, or where one stakeholder passes the baton to another as the workflow unfolds. But each phase corresponds to a series of challenges that confront both buyer and seller as they develop their relationship.

1. Identify a need

This can range from an uncomplicated order (a company is low on printing paper) to a purchase that is significantly more complex and costly (a property developer needs taps and sanitaryware for a hotel under construction).

However, in both examples, the impulse to initiate a purchase is straightforward because neither requires a decision: no paper, no printouts; no taps, no hotel. But there are many cases where identifying a need is in itself a gradual and complex process, particularly when it comes to investments in new technology.

A manufacturer of van racking solutions sold its products through a network of subsidiaries and export partners across 30 different sites, each offering its own slightly different UI and customer experience.

This blurred the brand message and was hard work for the digital marketers, who had to upload each piece of content 30 times. Clearly, there was a need to consolidate the digital landscape on a single platform – and the company consolidated its sites on a DXP.

But the decision to act could have been made much earlier – or considerably later – and this is where thought leadership plays an important role. In this use case, the customer experience starts before the need is clearly articulated, and before what we are defining here as the B2B buying process has got under way.

How can a B2B seller help initiate the purchase process where this requires a strategic decision? Answer: through thoughtfully positioned content that projects expertise and is willing to take a (big) step back from any final decision to replatform, much less the choice of DXP.

2. Research the Market

There is an avalanche of statistics that demonstrate the importance of this phase. Two jump out at us: the finding, by Forbes, that customers progress more than 70% of the way through the B2B decision-making process before engaging a sales representative; and secondly, that almost half of B2B buyers consume three to five pieces of a supplier’s content before that initial contact with sales.

In other words, if just one or two of those pieces of content are dull, inaccurate or not sufficiently informative, your sales rep will probably not be contacted.

DXPs invigorate content because editorial workflows are intuitive and fast, especially if you operate in different markets such as the manufacturer of van racking solutions in our example above.

The content should be accessible and consistent across every device and channel, and DXPs are uniquely capable of creating omnichannel customer experiences.

For B2B, omnichannel marketing is a do-or-die, rather than a nice-to-have – the recent experience of lockdown really brought home this message, as research by McKinsey bears out. In November 2021, when the end of Covid-19 was in sight, almost all (94%) B2B decision-makers were convinced that omnichannel was at least as effective as traditional face-to-face sales. At the start of the pandemic, this figure stood at 64%.

Buyers have to find you where they want to be – and if you’re not, it sends out a negative message about your brand (or worse, hand the initiative - and business - to your competitors).

Search is the all-important aspect of research – no surprise there. But what this means is that for a large part of the B2B buying process, and occasionally for all of it, you are almost wholly reliant on the search functionality of your site.

Buyers are more willing than ever before to spend big through remote or online sales channels, with 35% willing to spend $500,000 or more in a single transaction (up from 27% in February 2021). 77% of B2B customers are also willing to spend $50,000 or more

All DXP-led transformation projects prioritize search optimization as a key strategic objective. For B2B manufacturers that have built up huge product catalogs, this is one of their main anxieties about digitalization. “We have 100,000 SKUs [or a multiple of that], that’s just too many needles in a haystack. It’s too complex.”

DXPs can integrate with standalone third-party PIM systems, and some have the backend extensibility to absorb and make sense of those vast B2B catalogs. Best of all is to have a PIM that is native to the DXP, giving you maximum power and versatility without disruption to the UI.

What is pivotal is that the company looking for A4 printing paper, or the property developer researching taps and sanitaryware is inducted flawlessly in the B2B decision-making customer experience.

No use case stays simple for long. Take a distributor of printing paper. The business will be on a marketplace, competing mainly on price. It has little or no say over the customer experience, so what “content” is really required? What can you post on Instagram about a sheet of A4?

But this is not what happens. For B2B businesses, the purchase process is a cost so any inefficiencies in the process eventually find their way to the bottom line. The company administrator who needs printing paper also needs new office chairs, pens, staplers, PostIt notes, cleaning fluid for PC screens and keyboards, branded memory sticks for events and so on. What the administrator wants is a one-stop-shop for all his office needs which means the distributor of A4 paper will probably also sell filing cabinets and marker pens, perhaps on its own marketplace.

And so, very quickly, the modest search for A4 paper leads you to a DXP that brings together all product content, making that order process as painless as possible.

Not an easy task, because it turns out that a B2B buyer looking for 5,000 taps is almost as impatient as a B2C buyer looking for just one.

At every stage of the B2B decision-making process there is a lot to get right – and a lot that could go wrong.

3. Select a Supplier

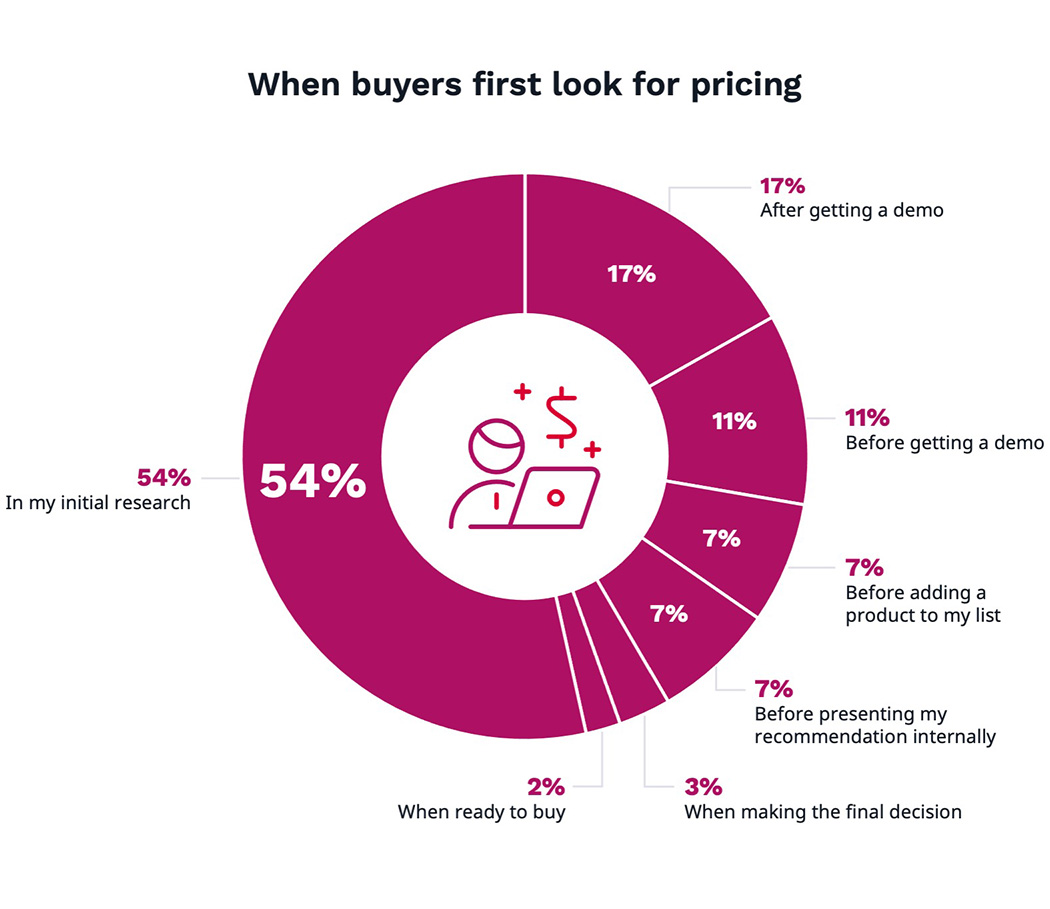

One unexpected obstacle is price transparency, even for technology purchases. Absence of pricing on the website is ranked second after cold calls in the list of “buyer irritants”, and more than half of B2B buyers look for price indications during the research phase. Even more remarkably, 16% will move on if pricing is not easily available.

This is interesting because most B2B sites are not transactional; the matter of price and purchase is usually left to the reseller, distributor, or wholesaler. But it seems buyers are not happy to wait that long so it is important that a DXP enables you to list custom prices and near real-time stock positions even if there is no e-commerce functionality on the site.

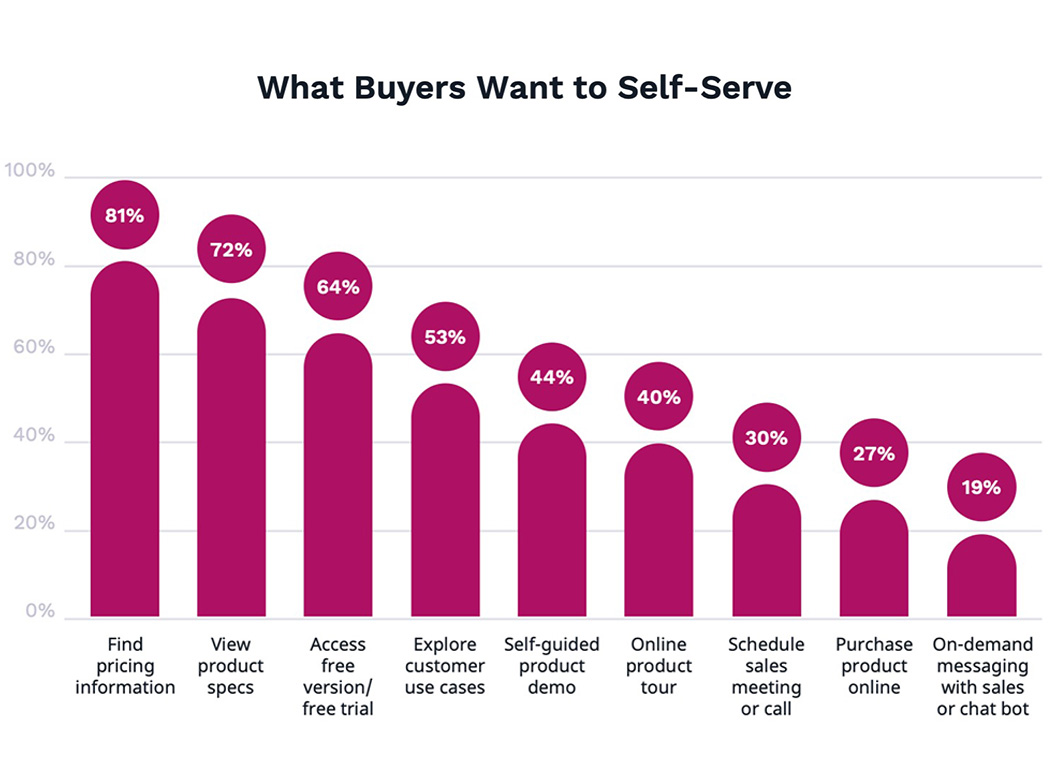

Source: TrustRadius: 2022 B2B Buying Disconnect: The Age of the Self-Serve Buyer

A complementary approach is for sales to provide more insight around pricing, once your reps are “looped in”. B2B buyers want (and have) more autonomy but are not prepared to give up on face-to-face visits altogether. In the latest McKinsey survey of B2B leaders, 76% of respondents describe them as a sign of how much a supplier values a relationship. Critically, 59% of customers say they will buy from a supplier only if they have met in person at least once before.

During the lockdowns, sales reps learned to use the time they saved on travel to leverage their expertise and knowledge of the customer with a more consultancy-type approach. But even before the pandemic, sales teams had to adapt to a B2B purchasing pattern that, without completely excluding them, was focused much more on self-service.

Sales reps are often resistant – initially – to digital commerce. In a B2B buying process directed by customer experience, they are no longer dominant in “clinching” a deal. Even the vocabulary seems outdated. Sales activities, like the DXP that supports them, have become “composable” in nature as the rep moves fluidly between social networks, web conferencing, face-to-face meetings and email to cement customer engagement. The success of hybrid selling depends on the rep, his customers, the warehouse and the company’s fulfillment partner all getting the same up-to-date real-time information about products and prices. We are back to omnichannel – all roads lead to that.

As the technologies of analytics advance, the consultancy aspect of hybrid sales assumes a greater importance, because the data helps the rep anticipate demands and developments the buyer himself had not foreseen.

This is sales without selling, where the rep works in collaboration with the customer to create business value – for the customer.

The choice of supplier depends on many things but only sales reps have the deep customer knowledge that can make the difference between a deal – or no deal.

Every B2B company is different and every B2B decision-making process has a different cast of stakeholders. Who decides? Who or what can sway the deciders? That’s the wisdom that sales reps must bring to the table.

4. Get Consensus and Approval

Even the simplest procurement – the A4 printing paper, for instance – has more than one participant. Clearly, the more complex, far-reaching or expensive the order, the more people need to get involved. If it was somewhat artificial to name five distinct yet overlapping phases in the B2B buying process, assigning “persona” to categories of stakeholders is completely self-defeating, because that process varies significantly from company to company, and different products occasionally trigger a different buying process within the same business.

The point to make is that there is always more than one buyer, and therefore more than one customer experience. We often say that DXPs “orchestrate” these omnichannel experiences across all the twists and turns of the B2B decision-making process. The metaphor is fitting because there are a lot of players – and they have to come in at the right time, at different touchpoints.

How many stakeholders are involved in a typical B2B transaction? The answers vary. One leading analyst puts the number at 11, others estimate an average of 7. What is important to our discussion is that B2B leaders are seeing this number go up as part of a buying cycle that is getting longer.

This is the paradox of the choice: the more of it you have, the harder it becomes to choose. The danger in B2B is that information and stakeholder bloat is slowing down the purchase process.

This is what lies behind the fascinating observation from Brent Adamson, the sales academic and author. “As hard as it has become to sell in today’s world,” he writes, “it has become that much more difficult to buy. The single biggest challenge of selling today is not selling, it is actually our customers’ struggle to buy.”

B2B companies are stepping up efforts to coordinate their decision-making by setting up buying committees; the Covid lockdowns created the condition where we all had to be much more strategic in the way we collaborate and seek consensus – and this encouraged teamwork across purchase stakeholders too.

These new collaborative structures are sound practice; this is why they outlasted the condition of lockdown that made them necessary. But the means of collaboration are extremely fragmented. An absorbing study of trends in tech buying describes the following information sharing landscape: email (68%), informal face-to-face meetings (35%), Microsoft Teams (34%), Zoom (26%), Google Docs (20%), Slack (20%) – there are others in the list which ends with Trello (3%).

Source: TrustRadius: 2022 B2B Buying Disconnect: The Age of the Self-Serve Buyer

As hard as it has become to sell in today’s world it has become that much more difficult to buy. The single biggest challenge of selling today is not selling, it is actually our customers’ struggle to buy.

How can B2B sellers help “uncomplicate” this process? One emerging trend is the so-called Digital Sales Room, a microsite where sales reps and B2B buyers collaborate and access content that is relevant to the sales cycle.

As we know, buyers do not move towards a purchase in a linear progression, but instead maneuver from site to site (or from site to sales rep) across different devices. The advantage of Digital Sales Rooms is that they give B2B buyers and sellers a single location – a point of reference – to which they can return throughout the cycle.

5. Build Relationships

For this final phase of the B2B purchase process we shall look at the digital transformation of one company, the world’s leading manufacturer of ophthalmic lenses, EssilorLuxottica. Essilor exemplifies many of the trends we have discussed in a wholly individual and innovative way.

First of all, the manufacturer did not conceive of the B2B purchase process as a singular transactional event: a single customer buying a pair of spectacles with an Essilor lens, or a chain of opticians ordering 10,000 lenses. Rather, digital commerce is a network of relationships – between Essilor and its European markets, its many distributors, and the millions of people wearing Essilor lenses (although they might not know that).

One of the main objectives of Essilor’s digital transformation was to educate its end-users about the brand, so the tone of voice is B2C: the site addresses itself to the end-users.

From a single instance of its DXP, Essilor rolled out the new site to its 22 European markets. Naturally, it encountered significant differences between individual markets, but the DXP’s out-of-the-box page-building tools made it quick and intuitive for each market to customize its site.

Essilor uses self-service and gamification to enhance customer engagement. For instance, users can do an eye test on the My Vision Check app, “configure” their own lens prescription which can be shared with one of the local opticians that are part of Essilor's distribution ecosystem.

An accurate and well-designed store locator extends the customer journey towards the opticians who, as a result of the relaunch, are enjoying much higher footfalls. The site is no longer B2C but B2C2B – the digital experience is relevant for all the participants in the purchasing relationship.

The Essilor sites are not transactional but they do “sell” by building thoughtful relationships with end-users and distributors. Before the launch of the replatformed site, Essilor nurtured its relationship with the opticians through gifts and loyalty schemes. It turns out that rising footfall and turnover are a more welcome guarantee of loyalty, and this is what Essilor achieved by reimagining the B2CB buying process.

What it Takes to Excel at Customer Experience

“How do I help our customers buy our product?” is not the same question as: “How can we sell our product to our customers?” You want to sell more, and the most sustainable and realistic way to do that is by being customer-centric, through buyer enablement.

The B2B purchase process is complex, and buyers will eventually go down the path of least resistance by directing their decision-making towards suppliers that offer the best customer experience.

If you want to be a gamechanger for your customers, you need a Digital Experience Platform that was built for B2B – with the power and flexibility to be transformative and relevant at every stage of the B2B purchase process we have analyzed in this blog.

The customer experience belongs to them, your customers. Your role is to communicate that you have understood the complexity of their decision-making and to craft experiences that leverage your insight and your empathy.